1. January 1980 - $39.28

2. March 2011 - $35.85

3. February 1980 - $35.60

4. February 2011 - $31.04

5. December 2010 - $29.44

It might be possible that April will be the best month ever as far as monthly average is concerned, or it as least now a viable target as silver closes the month a hair below thirty-eight dollars per ounce. Currently when silver is making new highs the term being used by myself and others is that of a "31 year high" as Silver reached over $50.00 per ounce in January of 1980. After this the word will become "All time high" by some people and myself I will use the term "Nominal High" as there is a lot of leg room to get back to previous areas when we adjust for true inflation that this world has endured over the last century or so. In the 1800s Silver was $1.293 per ounce which means it is up under 30x from where it was selling many generations ago. Considering the average salary in 1910 was $750 and we multiply this by 30 the total brings us to over $20,000 and with the average at over $40,000 in 2009 the wages have went up a total of over 50 times in less than one hundred years. The flaw here is that the average wage and median wage have a major disconnect because the rich bring the average much higher as the star celebrities, sports athletes and CEOs keep on bringing their riches in. Also this tells me that I am right that the USA dollar is closing in on losing 99% of its value since it begun almost a century ago. For this to happen you have to lose 100x the value on currency. 100 times the $1.293 number means silver over $129 per ounce which seems to be the fair value for silver these days. Have a long way to go, but have found no reason yet to see any long term topping action or an end to the brutal inflation we've had for many decades.

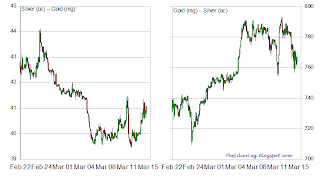

This is a nice looking chart and currently the price action is well above the 18 month average of highs, lows and closes in a large bullish trend with more upside potential. The reason the potential is very big is because of the last twelve candles or the last year. Last year at this time we were range bound from the $17.00 to $19.50 marks and broke the resistance in August of 2010 and started the bull market in September with a nice move higher. The final four candles gave us a nice time consolidation for the short term and now has broke resistance and is in the process of breaking out. All I want to say is that the market is not in need of correcting any further at this time and we need to have a much larger gain for me to see that "This chart is up too much right now." By shorting silver or selling because of this reason of the chart looking like it is too high is that of gambling and fighting the trend. If you profit take a little or if you hedge your bets a little, then those strategies usually can work well when you implement this within' your strategy.

This is a nice looking chart and currently the price action is well above the 18 month average of highs, lows and closes in a large bullish trend with more upside potential. The reason the potential is very big is because of the last twelve candles or the last year. Last year at this time we were range bound from the $17.00 to $19.50 marks and broke the resistance in August of 2010 and started the bull market in September with a nice move higher. The final four candles gave us a nice time consolidation for the short term and now has broke resistance and is in the process of breaking out. All I want to say is that the market is not in need of correcting any further at this time and we need to have a much larger gain for me to see that "This chart is up too much right now." By shorting silver or selling because of this reason of the chart looking like it is too high is that of gambling and fighting the trend. If you profit take a little or if you hedge your bets a little, then those strategies usually can work well when you implement this within' your strategy.  I stated in the monthly chart it was not over extended because it had the one candle time correction in January and a breakout since. This one is starting to become overextended. This quarter was the ninth straight positive one with an increase as well as the third straight significant gain. I would feel as if betting against Silver here is like betting against the hottest baseball or football team going whom has a nine game winning streak and thus the reason why they say in stock trading; "The trend is your friend." The path of least resistance is higher for this market and because it is only starting to become overextended this tells me we can easily see the gains continue or at least we are going to need those small gains getting above $60 aprx per ounce before it can go parabolic. The reason for this is when markets are up way too much or are very over extended then you would expect not only for volatility to rise, but for either topping action of some sort or a major up move as the psychology of resistance not being acted as such when it is supposed makes the gains go to parabolic levels. The same can be said for down moves when support is not found at key areas, but this market is bullish and we will use the example that we see here. Once again another reminder that the market was $50.00 back in 1980 and thus this gives us price history data to clarify higher gains and by extending the math further a dose or tablespoon of inflation here and there shows much higher upside potential.

I stated in the monthly chart it was not over extended because it had the one candle time correction in January and a breakout since. This one is starting to become overextended. This quarter was the ninth straight positive one with an increase as well as the third straight significant gain. I would feel as if betting against Silver here is like betting against the hottest baseball or football team going whom has a nine game winning streak and thus the reason why they say in stock trading; "The trend is your friend." The path of least resistance is higher for this market and because it is only starting to become overextended this tells me we can easily see the gains continue or at least we are going to need those small gains getting above $60 aprx per ounce before it can go parabolic. The reason for this is when markets are up way too much or are very over extended then you would expect not only for volatility to rise, but for either topping action of some sort or a major up move as the psychology of resistance not being acted as such when it is supposed makes the gains go to parabolic levels. The same can be said for down moves when support is not found at key areas, but this market is bullish and we will use the example that we see here. Once again another reminder that the market was $50.00 back in 1980 and thus this gives us price history data to clarify higher gains and by extending the math further a dose or tablespoon of inflation here and there shows much higher upside potential.Not sure yet if this is the last post for the day for the blog. There will not be a video until tomorrow and this weekend I want to talk more on the gold to silver ratio as well as the palladium to silver ratio. Thank you for stopping by today.