MANIPULATION 101!

This chart above has been MANIPULATED! I am the Manipulator! I have exerted shrewd and devious tactics to my advantage! What I normally do to manipulate this 15minute line chart is import the 15m data from the SLV shares and I increase the variables by exactly 1.022837066 greater to match the comex fixings. That is not what the manipulation is here. What the manipulation was putting the value of $33.56 in after the 4pm Friday close and before todays 9:30am open. The value of 33.56 x the rate mentioned earlier equals $34.33 which translates to the top of the market almost one day ago. I am using this to my advantage, because this can help me with potential future trend line analysis as well as eyeballing fibonacci levels or anything that may be needed for having this level in place. I will talk more about manipulation at the bottom of this page.

However, as far as what this charts shows us is that the price movement lower has sent us back to the trend line. As long as this market stays in this trend channel, then it will remain very bullish. Often times when you have a big price increase and you do not like getting into the market when its up so much then one may want to wait for a significant pull back. Well here we are, as this was a retracement of around $2.00 from it's high. I often have people asking if they think there will be a pull back, and of course there will be and trying to guess tops and bottoms is a hard game to do. I never tried to on this one like I did at the end of 2010 with the $31 level

INTRA DAY CHART

Mainly a sideways day on the New York Time frame as the selling came in the morning. The silver lining here is that the broad indices got hammered today as the Dow Jones was down around 200 points and the Nasdaq was done 75 points. Platinum, Palladium and Copper all got hammered today, while Gold and Silver survived the thrashing pretty good. If you are wondering if this market was Manipulated today, it would probably be best to give you my opinion which is that: YES, but every day is manipulated. Often times on down days I hear many bullion bugs state that its manipulation that this is happening. They are right, but it was manipulation that seen the market go up from $26 to $34 as well. If the market sells off in a decent amount of time a decent amount of percentage points, then the physical market will not be happy and may not reduce their selling prices that much. After all, they know this is all manipulation. Well if thats the case, why even sell bullion 999 silver at $80? It's going much higher than this very soon.

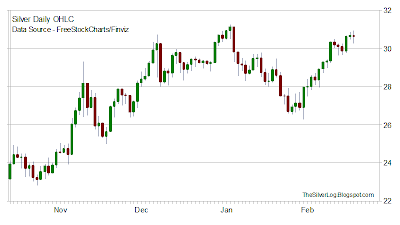

Daily Chart

A decent size red candle, but this is after three big green candles in what was already a strong trend. The key support level on any big moves lower is $31.40. This was that big key resistance level way back when, and now it is support. Before I said that i wanted to wait to buy around $26 or a confirmation above $31.40. Well, i bought at $28 on the day after the bottom and I will inform you on this blog when I see confirmation of a break above this massive fibonacci level. It's easier for me to confirm this if we retrace back to or close to this area, but either this baby will get confirmed one way or another on technical analysis. As far as fundamental analysis, confirmation is so set for this to scream higher and technical analysis has already confirmed a move to the $48.36 area on the longest of term charts. Because of this, I refuse to get shaken out by any of this non sense selling.

MANIPULATIONIt would be so cool to chart how the big banksters were and are manipulating not on this silver market, but so many different markets and aspects of culture. They manipulated the currency so that they would go well out of their way to keep us the people in form of how money is created and how debt is 100% guaranteed by using mathematical formulas. One of the many ways it seems that was done was the suppressing of the gold and silver market for quiet some time. How many of you people were excited and enthusiastic to buy silver back in 1990 or 1995 or 2000 or 2005 at these firesale levels? I was not one, because at that time frame I never even considered silver as a way to make investments. This was not stated on the television screens that I had watched at the time. Then there may have been some other peoples whom knew it was manipulated then and still didn't buy because they thought the manipulation to the down side was not over yet. Any way you put it manipulation is there and when you see the definition of what manipulation means you can find it to state

exerting shrewd or devious influence especially for one's own advantage which is what the bankers do. It's to their advantage to keep us enslaved in this money debt system so that they can keep their ponzi game going as they try to be the kings of this planet. What shrewd or devious stuff they do is impossible for me to answer. I know some of the stuff that they do is short sell the price of silver to lower the prices down. They use fractional reserve banking and one way within' silver this is done is having a lower inventory of bullion than they offer for sale. You can comment on this page with a google account, and would love to hear what you have to say about silver manipulation. I have included a nice link from

Bix Wier from Road to Roota which has some good information on it. Thank you for stopping today and keep stacking.