All my condolences go to the people affected in the Japan area that was affected by the monster earthquake and tsunami. Earth changes are here and if this has affected you directly, then all the best in your recovery. If this has not affected you personally then this should be a wake up call for the earth changes going on right now. Silver is important for protecting for a currency collapse as well as investing for higher gains. Food, water, shelter and emergency supplies are more important.

I wasn't planning on updating this blog until the market closed, but this ride is getting wild. The price action has seen the market go from a low of $34.08 this morning when the USA markets opened and is now closing in on $36.00 per ounce. This is a massive gain and has managed to proceed to the rising five day moving average you can see on the chart (Click on the chart to enlarge it). It shows the latter part of this average declining at the end, and this will only be the case if the market falls from here. If this area is resistance and it falls lower, then watch out! However, the movements are creating a lot of volatility in this market as we head into the weekend. My personal bias right now is that this move to these lows was a shake out to get some people out of some long positions whom have stop orders in. This is why I am so heavily against stop orders (if one trades), because it exposes the trade to the powers that be and thus it's like playing a game of poker with your hand face up. These types of tactics are the reason i do not like the paper market period. It's a total fraudulent system to the say the least because of its heavy corruption.

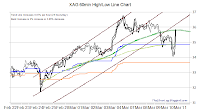

I wasn't planning on updating this blog until the market closed, but this ride is getting wild. The price action has seen the market go from a low of $34.08 this morning when the USA markets opened and is now closing in on $36.00 per ounce. This is a massive gain and has managed to proceed to the rising five day moving average you can see on the chart (Click on the chart to enlarge it). It shows the latter part of this average declining at the end, and this will only be the case if the market falls from here. If this area is resistance and it falls lower, then watch out! However, the movements are creating a lot of volatility in this market as we head into the weekend. My personal bias right now is that this move to these lows was a shake out to get some people out of some long positions whom have stop orders in. This is why I am so heavily against stop orders (if one trades), because it exposes the trade to the powers that be and thus it's like playing a game of poker with your hand face up. These types of tactics are the reason i do not like the paper market period. It's a total fraudulent system to the say the least because of its heavy corruption. The key fibonacci level is $35.73 which is where we are now. If this level gets taken out, this signifies that the entire move down of almost three dollars an ounce is a failure. Long term thats a guarantee on so many principles, but on the short term level this means a fast move is likely to follow this failed move which should at last take us back to the previous high of the high $36 level. I don't want to jump the gun as of yet because this is merely a test of this fiboancci level. This could be an area where people stop buying because its up too much short term or an area where shorts will stop covering. It could also be an area where some will short this market because it is at a key level of resistance. If the market keeps moving higher, this tells me those reasons just stated in the last sentence did not happen and there is a lot of energy forces within' this market which is the fundamental reason for why fast moves follow failed moves. More on the blog after the close or if more massive volatility continues.

The key fibonacci level is $35.73 which is where we are now. If this level gets taken out, this signifies that the entire move down of almost three dollars an ounce is a failure. Long term thats a guarantee on so many principles, but on the short term level this means a fast move is likely to follow this failed move which should at last take us back to the previous high of the high $36 level. I don't want to jump the gun as of yet because this is merely a test of this fiboancci level. This could be an area where people stop buying because its up too much short term or an area where shorts will stop covering. It could also be an area where some will short this market because it is at a key level of resistance. If the market keeps moving higher, this tells me those reasons just stated in the last sentence did not happen and there is a lot of energy forces within' this market which is the fundamental reason for why fast moves follow failed moves. More on the blog after the close or if more massive volatility continues.IF YOU HEAR ON THE NEWS ABOUT REASONS WHY MARKETS GO UP AND DOWN, IT WAS MAY 6, 2010 WHERE IT WAS A FAT FINGER TYPO CAUSING THE DOW TO PLUMMET OVER 600 IN UNDER 6 MINUTES! MY MESSAGE IS DON'T BELIEVE THE HYPE! CHECK THIS VIDEO BELOW. SORRY FOR THE CAPS, BUT THIS IS IMPORTANT INFO!

Cyrus992 asks why Oil went down and metals went higher. The answer is they both traded together, yet the silver market performed much better. The image below takes the last 24 hours on both Silver and Oil from Finviz and if you take a trend line and draw the open to the close on both silver and oil you will see that silver has an uptrend and oil a downtrend and the only reason this is the case on chart level is because when silver went higher this morning it got back all of its losses and then some, while Oil only got back around a little over half of them.

Cyrus992 asks why Oil went down and metals went higher. The answer is they both traded together, yet the silver market performed much better. The image below takes the last 24 hours on both Silver and Oil from Finviz and if you take a trend line and draw the open to the close on both silver and oil you will see that silver has an uptrend and oil a downtrend and the only reason this is the case on chart level is because when silver went higher this morning it got back all of its losses and then some, while Oil only got back around a little over half of them.Thank you for stopping by.

Thanks for your daily update on Silver. I am from India. My day starts with reading your blog. I am a nebiew in commodity market. I just trying to understand how i can make money by investing in Silver. Initially i planned to buy Silver in phisical form and hold for 1 year. But storage and risk of Security is the concern. In India we do not have Silver ETF or any e-form buying. But we can buy Silver Futures in commodity market. I would like to Buy each maonth contract from May to Dec 2011 and close the positions each before expiry. I do not know whether it is a best strategy. I request your guidance. And another concern is now Silver is at all time high. is it a right time to take a positional trade? Thanks in advance.Chenna

ReplyDeleteDerek, You have explained the technical reasons why silver went up and oil went down.

ReplyDeleteI feel Cyrus was curious about the fundamental reasons. Because of this earth quake, Japan economy will take a hit and all commodities should have taken that hit today and not just oil.