Pure blood bath in the market as its been a very wild roller coaster. This market can go lower and $39.00 as a conservative target now seems like a sure shot now to be tested soon. It is oversold now and is due for a bounce, but as long as there are people willing to sell and not enough new buyers it will go lower. If it goes lower, let the disconnect begin and if not its a super failed move, but that aint the case and this is a intermediate bear market now. To those people who say "it has even started" I have to tell you. "It has just started" and although I expect volatility to slow down for a little bit, we are on our way to those explosive days ahead and movements today are the reason why I hold silver because of how corrupt the world banking system is. In a sane world that values their assets you would think that a move that takes one fifth of its value away would be catastrophic for its uses going lower, inventories and productions getting way to high and for that to occur in less than forty-eight hours would because some sort of storm came in and then BOOOM! Well a storm obviously did occur and its a financial storm of some sort. The dollars still going to do and to think that the world bankers are not going to go down without a fight is insane. I heard again today that they raised margins again on silver and I don't know, nor do I really care. This margin crap and SLV ETF gambling is nothing more a ponzi scheme and people need to know this now more than anything. There have been many people betting on margin whom are getting crushed right now and many people have made more money this week shorting it down or cashing in their PUT contracts than people make in a year doing hard work that could help this planet evolve in a positive manner. If I were to put $25,000 on SLV PUTS at the end of last week and cash them at the end of the day today I could easily turn these into $125,000 and make 5x my money back because I was smart enough to buy the ones that cost only 40 cents that are worth four dollars to make my heft gains. Yet this individual would have made more than a teacher whom is helping a few dozen children learn important things in this world. How productive is it to wager money while sitting your butt on a comfy chair and then selling them for a massive profit as you click your mouse a few places and put a few pass codes in? This is how the world is working and nothing will change until people do something about it.

Pure blood bath in the market as its been a very wild roller coaster. This market can go lower and $39.00 as a conservative target now seems like a sure shot now to be tested soon. It is oversold now and is due for a bounce, but as long as there are people willing to sell and not enough new buyers it will go lower. If it goes lower, let the disconnect begin and if not its a super failed move, but that aint the case and this is a intermediate bear market now. To those people who say "it has even started" I have to tell you. "It has just started" and although I expect volatility to slow down for a little bit, we are on our way to those explosive days ahead and movements today are the reason why I hold silver because of how corrupt the world banking system is. In a sane world that values their assets you would think that a move that takes one fifth of its value away would be catastrophic for its uses going lower, inventories and productions getting way to high and for that to occur in less than forty-eight hours would because some sort of storm came in and then BOOOM! Well a storm obviously did occur and its a financial storm of some sort. The dollars still going to do and to think that the world bankers are not going to go down without a fight is insane. I heard again today that they raised margins again on silver and I don't know, nor do I really care. This margin crap and SLV ETF gambling is nothing more a ponzi scheme and people need to know this now more than anything. There have been many people betting on margin whom are getting crushed right now and many people have made more money this week shorting it down or cashing in their PUT contracts than people make in a year doing hard work that could help this planet evolve in a positive manner. If I were to put $25,000 on SLV PUTS at the end of last week and cash them at the end of the day today I could easily turn these into $125,000 and make 5x my money back because I was smart enough to buy the ones that cost only 40 cents that are worth four dollars to make my heft gains. Yet this individual would have made more than a teacher whom is helping a few dozen children learn important things in this world. How productive is it to wager money while sitting your butt on a comfy chair and then selling them for a massive profit as you click your mouse a few places and put a few pass codes in? This is how the world is working and nothing will change until people do something about it.News Story Review

Video Link

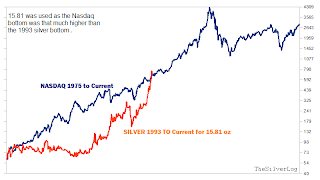

I happened to come across a story from Yahoo Finance with Don Harrold on the show. You know the guy who keeps putting up videos and then removing them (over and over and over again) as they were talking about a silver bubble. Jeff Macke was the host of the show and I know that these two people are friends, so this is not that much of a surprise to me that this occurred. I have wanted to stay below the radar for the most part, and am glad that I have done so. Don first states that the Nasdaq and the Silver have the exact same chart before the bubble. I think Don uses the word "exact" extremely loosely because he failed to point out was that the Nasdaq never had a major correction before it rallied on his chart. It went from around 50 to 5000 in a little over 25 years and thus this throws away the reason that a market has to top after ten years of good gains.

The increase was that of almost 100x times its values. Yet, the so called guru of Don Harrold is trying to tell us that it is the exact same? If we divide our current price of silver by 100 we get under fifty cents and thus this is not a fair comparison. If we multiply the bottom of $3.50 by 100 we would get $350. It seems all the people calling silver tops are ignoring the quarterly chart and the fact that it is still so way undervalued. Yes they may say it was the "Hunt Brothers cornering the market" and if they truly believe that then I do not know if I should laugh or cry.

The increase was that of almost 100x times its values. Yet, the so called guru of Don Harrold is trying to tell us that it is the exact same? If we divide our current price of silver by 100 we get under fifty cents and thus this is not a fair comparison. If we multiply the bottom of $3.50 by 100 we would get $350. It seems all the people calling silver tops are ignoring the quarterly chart and the fact that it is still so way undervalued. Yes they may say it was the "Hunt Brothers cornering the market" and if they truly believe that then I do not know if I should laugh or cry.Another note that Mr. Harrold pointed out was that of the Dow to Silver ratio and how its under its historic average and thats an indicator for a silver bubble. He even said that the ratio once got to 50 to 1 on the 1980 peak and when the Silver price was $50.00/oz that means by multiplying this by 50 you would get $2,500 and you can check all you want, but the Dow was never close to this and the ratio was under 20 to 1 in reality in January/1980. I said earlier this weekend that technical analysis is 100% when your data is correct. When you have someone telling us the bottom was a 50 to 1 ratio and by not using the 1975 Nasdaq lows this tells me the data he used was not accurate and thus there is major flaws in his research. At the five minute mark of his video he said there has been 13x of a dollar loss since 1913 when the CPI calculator will state that its 22.57x its value and even that level is definitely wrong as it is closer to 60-90x loss. Don also says the chart looks like its up too much and yet he fails to use a logarithmic chart in a heavy inflationary environment. If you want to listen to someone whom removes there videos every now and again, then go right ahead but Don Harrold to me is becoming one of them in that the mainstream media type thinking in lying to the people. Maybe Don feels genuine about his decisions and is not aware that he is using inaccurate data, and maybe Don doesn't know how money is created because if he did then he would realize that for the first time ever we have hundreds of thousands of people every day waking up to how money is created and we are closing in on the end of the mayan calendar which has been extremely correct up to now which would be dumb to deny such a thing. Granted it is very hard to find good information and when people search the mayan calendar it will be hard to find genuine info as a lot of it is fear mongering with many half and quarter truths.

There a difference from an intermediate term top and a long term top. I am not calling a long term top like Mr. Harrold is and I think an intermediate term top is possible. My final point is there has only been two people whom has ever wanted me on a show before and that was Jack DeAngelis earlier this year and once I was on Wide Awake Radio. Unfortunately Jack stopped his videos because many people on the internet came on stating him to be a fraud and thus Jack has stopped doing videos. Those people whom ripped Jack won I guess. I don't know the story of what really happened, but my point is that Jack is the only person that has ever invited me to a show to talk about silver and maybe Don mores than I do. I don't know, but my guess is that because he is good friends with Macke that he put him on the show. I am happy staying in the backseat or behind the radar with my analysis that I feel is up there as the best with silver analysis. This is only my opinion, but maybe it is wrong because I don't know what I am talking about. I very highly doubt that,but time will see.

There a difference from an intermediate term top and a long term top. I am not calling a long term top like Mr. Harrold is and I think an intermediate term top is possible. My final point is there has only been two people whom has ever wanted me on a show before and that was Jack DeAngelis earlier this year and once I was on Wide Awake Radio. Unfortunately Jack stopped his videos because many people on the internet came on stating him to be a fraud and thus Jack has stopped doing videos. Those people whom ripped Jack won I guess. I don't know the story of what really happened, but my point is that Jack is the only person that has ever invited me to a show to talk about silver and maybe Don mores than I do. I don't know, but my guess is that because he is good friends with Macke that he put him on the show. I am happy staying in the backseat or behind the radar with my analysis that I feel is up there as the best with silver analysis. This is only my opinion, but maybe it is wrong because I don't know what I am talking about. I very highly doubt that,but time will see.

No comments:

Post a Comment